In this very hazardous life, we would all like to be able to have the certainty that nothing bad will ever happen to us, but it is impossible. We must live with that annoying company of uncertainty and, some more than others, it is hard for us to realize that we can not control everything in life, largely because many things do not depend on us. For all these reasons, it is important to anticipate what might happen and buying home insurance is one of the most important things we can do to protect ourselves. In this article by ShBarcelona we want to talk about the reasons for buying home insurance.

Related Article: How to get your boating license in Barcelona

Table of Contents

Your House, Your Treasure

Photo via Pixabay

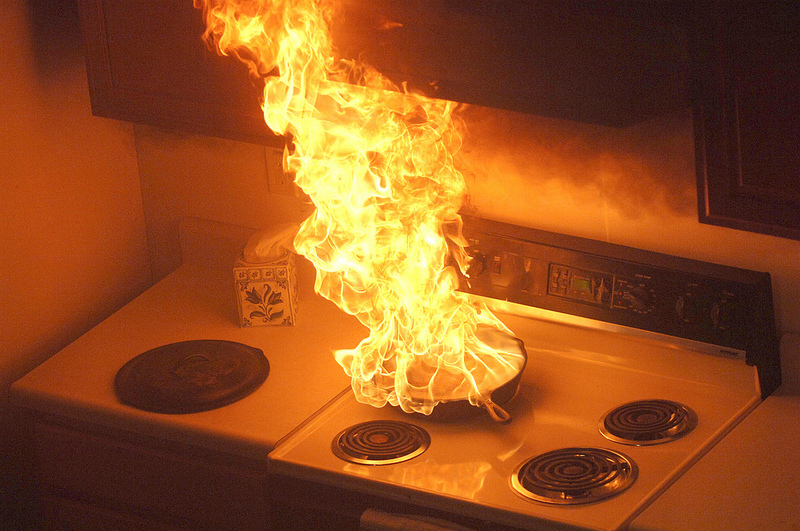

Our home is our refuge and where we usually have our valuables, whether of economic or sentimental value. We like to have, as George Carlin would say, “a place for my stuff.” For this reason, it is important to have insurance that protects all of that, in addition to the costs that may represent different incidents that cause damage to your homes, such as a fire, a flood, natural disasters, and criminal theft. This is all reasonably plausible and that, therefore, it is necessary to contemplate buying (there may be laws requiring you to buy some form of home insurance). There are several types of policies that, depending on the needs of each one, can be more or less advisable. It is based on the value of the house and how much it covers in the event of an accident, criminality, or force majeure.

Continent And Civic Responsibility

Photo via Pixabay

The “continent policy” covers the walls, ceilings, installations, and floors of your home. It is basic in case of having an isolated house, such as a chalet, or a property that does not belong to an entire community. In case there is a community, their hiring should be assessed if the community insurance is very limited or only covers common areas, although some personal policies already include it by default. The contents are the valuables that are in the home. They can be appliances, furniture, jewelry, clothing or electronic items such as computers, televisions, tablets or mobile phones. If you are a tenant and have few valuables you cannot hire, as a landlord who leaves the apartment without furnishing. Otherwise, it is interesting to have it. Remember that the content policy is always in charge of the owner in case of rental.

Related Article: Services that offer home massages

Then, there is the civil liability insurance, although not mandatory in the case of home insurance, it can be valuable in the event of an alleged serious mishap caused by carelessness, such as a fire from leaving the cigarette lit, and causing physical damage to third parties. It can represent large compensations that are very difficult to pay for the cause of the loss, greatly reducing the basis of this. Having home insurance is essential to try to anticipate multiple unforeseen events that may arise in our home and a way to feel more secure. If you have questions, you can contact our insurance department of ShBarcelona, where they will be happy to advise you.

What do you think about home insurance? What do you advise us about?

Leave a Comment